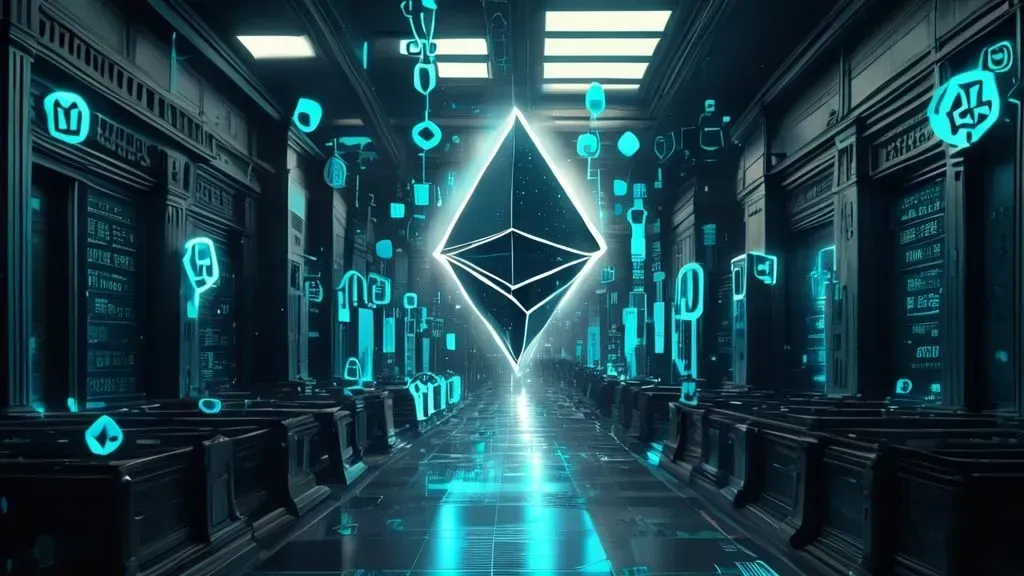

Crypto PAC Fairshake Amasses $193M for 2026 US Midterms Push

Pro-crypto super PAC Fairshake now holds over $193 million from industry giants ahead of the 2026 midterms. This funding surge, led by CeFi leaders like Coinbase and Ripple, signals the sector's growing political clout. Will it reshape regulations and boost centralized finance innovation?