Do Kwon's Sentencing Hearing Drags Amid Victim Testimonies in Crypto Fraud Case

Date Published

The 2022 TerraUSD and Luna collapse erased over $40 billion in market value, shaking the entire crypto ecosystem. This event accelerated regulatory scrutiny on defi projects and stablecoins worldwide. Investors lost life savings, prompting calls for stronger security measures in web3 technologies.

Background on the Terra Collapse

Do Kwon founded Terraform Labs, promoting TerraUSD as a stablecoin tied to advanced technology. In reality, secret interventions propped up its value, leading to fraud charges.

The crash impacted cefi and defi sectors, with cascading effects on funding and rates. Market volatility surged, affecting nfts and metaverse projects too.

According to Reuters, Kwon pleaded guilty to conspiracy and wire fraud in August 2025. He admitted misleading investors about the stablecoin's restoration mechanism.

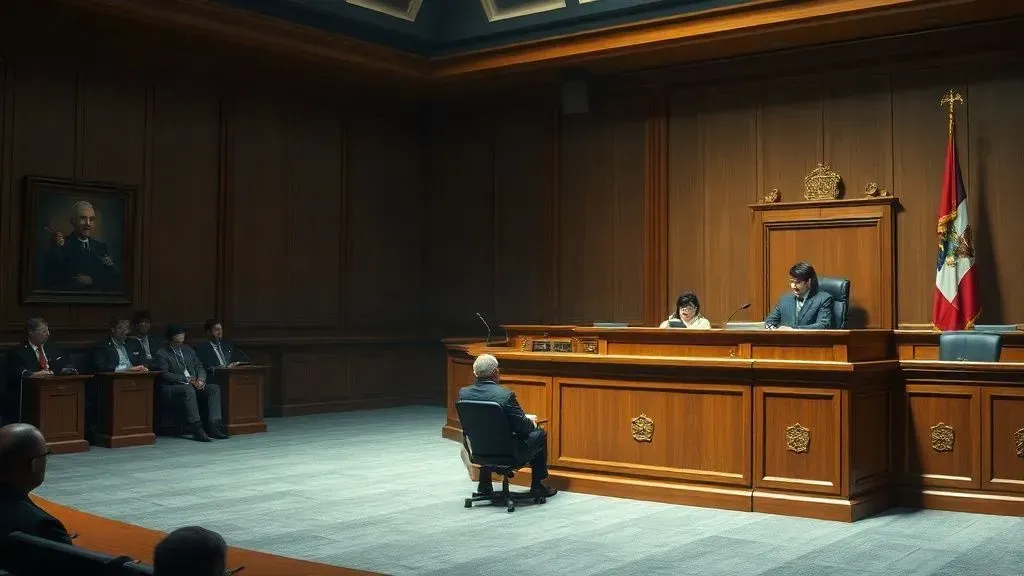

The Ongoing Sentencing Hearing

The Manhattan hearing started on December 11, 2025, but dragged due to 315 late-submitted victim impact statements. Judge Paul Engelmayer criticized prosecutors for the delay.

He offered a postponement of up to six weeks, but Kwon's defense declined. This decision allowed the proceeding to continue despite the influx of testimonies.

Victims spoke directly, sharing personal devastations from the collapse. One organization lost funds meant for charities, forcing retirements to delay.

Victim Testimonies Highlight Human Costs

Chauncey St. John described guilt over family losses in Terra investments. "I have to live with the guilt of their losses every day," he stated in court, per CoinDesk.

A Russian woman recounted becoming homeless after her $81,000 investment dwindled to $13. She emphasized the moral damage inflicted.

Another victim faced divorce and altered family plans due to financial ruin. Sons skipped college for mechanic jobs instead.

One testimony implied a friend's suicide linked to the losses. These stories reveal deep impacts beyond market figures.

Legal Arguments and Potential Outcomes

Prosecutors seek 12 years in prison, citing the massive fraud's role in broader market crises. They highlight Kwon's misleading promotions.

Defense requests five years maximum, noting harsh Montenegro detention and likely South Korean extradition. Combined sentences could exceed reasonableness.

Judge Engelmayer demanded clarity on South Korean proceedings. He stressed better victim notice practices for future cases.

"You need to do better," the judge told prosecutors about late submissions, as reported by CoinDesk. This reflects procedural tensions.

Market Reactions and Trends

Luna and Luna Classic prices surged initially amid hearing buzz, up over 200% recently. However, they dipped as testimonies unfolded.

This volatility shows how legal events drive crypto market movements. Traders price in narratives over fundamentals often.

According to Decrypt, the Department of Justice pushes maximum penalties reserved for Kwon. This signals stricter enforcement.

Implications for Crypto Regulation

The case sets precedents for defi accountability, per AInvest reports. Regulators may tighten stablecoin oversight to enhance security.

Web3 adoption could slow if founders face heightened risks. Yet, it promotes ethical technology development in the sector.

funding for cefi platforms might shift toward compliant models. Market stability hinges on resolving such uncertainties.

Analysts from Cryptorobotics note multijurisdictional challenges reshaping crypto landscapes. This fosters mature regulation frameworks.

Broader Relevance to Crypto Ecosystem

This sentencing underscores vulnerabilities in defi and the need for robust security protocols. It educates investors on risks, promoting informed adoption across web3, nfts, and metaverse spaces.

Ultimately, the outcome influences global regulation, balancing innovation with market protection for sustainable growth.