Banks, Not Stablecoins, Anchor Digital Money: Italy's Stance

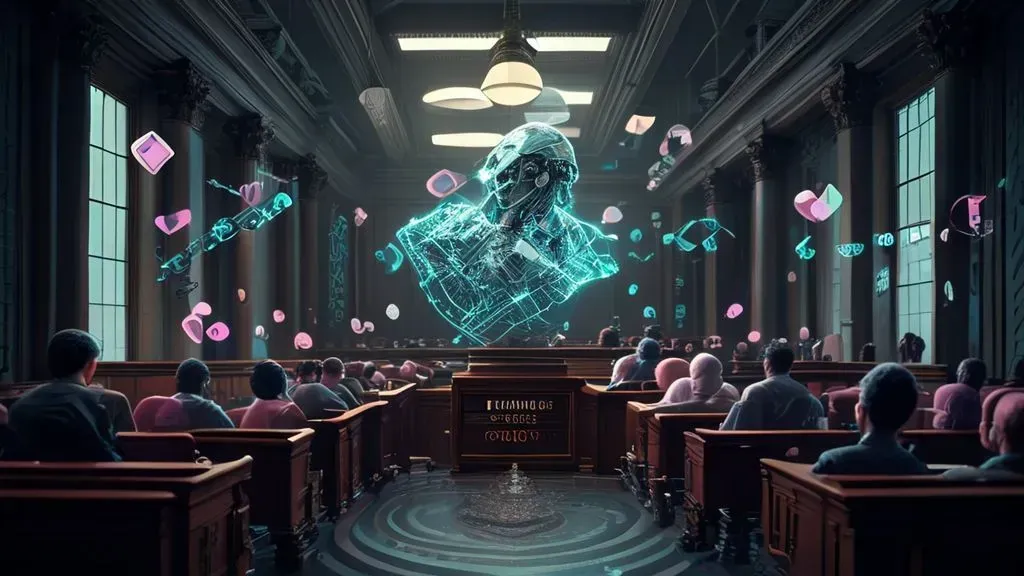

Stablecoins have exceeded $180 billion in market value, fueling debates on digital finance stability. Bank of Italy Governor Fabio Panetta argues banks must lead by issuing tokenized money. This highlights key tensions in adoption, regulation, cefi, and defi.